Update

Update

ABOUT MUTUAL FUNDS CAN I GET SOME SIMPLE NARRATION THAT A COMMON INVESTOR CAN UNDERSTAND ?

CAN I VIEW A SAMPLE EQUITY PORTFOLIO DESIGNED BY A MUTUAL FUND CO. ?

I AM A NEW INVESTOR IN MUTUAL FUNDS, HOW SHOULD I BEGIN MY INVESTING JOURNEY WITH MUTUAL FUNDS ?

WHAT ARE LARGE CAP, MID CAP, SMALL CAP, MULTI-CAP ORIENTED AND OTHER TYPES OF EQUITY MUTUAL FUNDS?

WHAT ARE LARGE CAP FUNDS?

WHAT ARE INDEX FUNDS?

SHOULD I CHOOSE LUMP SUM OR SYSTEMATIC INVESTMENT PLAN?

SHOULD I CHOOSE THE GROWTH OPTION OR DIVIDEND OPTION (INCOME DISTRIBUTION AND CAPITAL WITHDRAWAL OPTION)?

CAN I BOOK PROFITS WHEN MY INVESTMENT HAS GROWN?

ABOUT MUTUAL FUNDS CAN I GET SOME SIMPLE NARRATION THAT A COMMON INVESTOR CAN UNDERSTAND?

To answer your question, you need to be first convinced about the history of how mutual funds came into existence and the purpose of mutual funds.

Mutual Funds are a “collective investment scheme” that originally started in the year 1772-73 in the Netherlands (Dutch – Amsterdam) after the country witnessed a financial crisis. The risk is inherent in the financial instruments which needed to be hedged building a safety net of protection for common investors with their savings. Mutual funds provided such an opportunity to bring together common people into a group by mobilizing their savings, creating a pool of funds, and investing in predefined financial instruments managed by experts.

The concept found acceptance over the years and during the 1890s mutual funds were introduced in the United States of America and gradually found its foot in other parts of the world. In India, mutual funds were introduced in the year 1963 and the first mutual fund was launched as Unit Scheme 1964, commonly remembered as US-64.

The government wanted common people to participate as investors in instruments other than traditional products such as fixed deposits, post office savings, gold, and real estate. The obvious alternative investing option was offering stock markets or equity markets (and of course the debt market or fixed-income market) to common people. However, the stock market and debt market can be complex for common people to understand or make prudent investment decisions. Several common problems were identified such as

The answer to all the above questions is “mutual funds.” Let us understand what mutual funds are with a simple example. There is a company named Maruti Suzuki that everyone knows and identify the company as a good company because we all have driven or sat as passengers in the car manufactured by Maruti; this company even today commands over 50% market share in the passenger car segment.

Assuming you like this company or stock and wish to own at least one share of this company; you checked the price and saw that it was quoted at Rs.10000 per share. Can you afford to buy at the given price? Most common people would say it is beyond their capacity to buy at this price; they think it is costly. The stock may not be costly, but it definitely seems unaffordable.

Observe the real price of Maruti Suzuki shares as quoted on the stock exchange:

The company is good but the price of Rs.10418 per share seems unaffordable; how to solve this problem of owning a good stock without investing a large amount?

As you think that Maruti is a good company, don’t you think there are many others like you in the country (in India) who too think that Maruti is a good company? Perhaps, they too cannot afford to buy the shares at the given price. Indeed, there are millions of people like you; all we must do now is to bring together more people into a group and ask them to contribute a small amount such as Rs.500 per person. We first would need 20 common people who can contribute Rs.500 which would take the amount to Rs.10000 (Rs.500 x 20 people = Rs.10000); the responsibility of mobilizing 20 people let us leave it a smart and intelligent person (we can call him as a fund manager or a mutual fund company) who has solutions to problems we discussed earlier about stock markets.

The 20 people will hand over Rs.500 each to this expert who will now buy one share of Maruti Suzuki at the price of Rs.10000; further, the 20 people are owners of one share of this company (similar to multiple people owning an apartment building with their individual flat and ownership). Before anything else we learn, first answer this question: Why does anyone want to buy or own Maruti Suzuki company shares? You are using your common sense that Maruti company would be selling more cars in the coming years leading to an increase in sales and also an increase in the profits of the company. If the company performs well, you are again using your common sense that more people would want to buy this company shares where demand could push the prices to higher levels; the price might rise above Rs.10000 and such a rise in price would lead you to make gains. Are we correct in our understanding so far?

Please note that during the year 2003, Maruti Suzuki sold their company shares for the first time to the public through a public issue at Rs.125 per share; after 20 years, in 2023 the stock price is quoting at approx. Rs.10000. It means in 20 years the stock price has risen from Rs.125 to Rs.10000 levels; do you realize what is the annual growth of its price and the investment valuation? See the below illustration tables:

| Maruti Suzuki’s Current Share Price (per share) | Rs.10,000.00 |

|---|---|

| Original Price of the Share (in July 2003) | Rs.125.00 |

| No. of years (2003 to 2023) | 20 |

| Compounded Annual Returns | 23.84% |

| Investment Cost in 2003 (100 shares x Rs.125) | Rs.12,500 |

|---|---|

| Compounded Annual Growth | 23.84% |

| No. of years of holding the stock | 20 |

| Current Value of Investment in 2023 | Rs.10,00,000 |

The interpretation of the above calculations is that the annual growth of the stock price has been around 24% and an investment of Rs.12500 (buying 100 shares during 2003) would have grown to become Rs.10.00 lakh in 20 years. Maruti has continued to do well despite a competitive car market and still commands a premium company tag among the passenger car segment.

It is common sense to assume for common people that the price of this company could rise in the future too and maybe it is worth buying it now for future gains.

Continuing with our example of 20 people contributing Rs.500 each and buying one share of Maruti, two possibilities are there after buying: the price may rise or the price may fall. Assuming the price rises by 10% which means the stock gains Rs.1000 (10% of Rs.10000); who do these gains belong to? Obviously, the gain belongs to 20 people who own the share, and let us share Rs.1000 with 20 people at Rs.50 per person. Each person’s investment of Rs.500 has grown by 10% to Rs.550. See, the profit got distributed among 20 people.

What if the stock price had fallen by 10%? The loss per investor would have been Rs.50; the investment of Rs.500 would have become Rs.450. Here the loss of just Rs.50 does not hurt or does not lead to panic; such small losses are affordable and acceptable. Moreover, the loss is not incurred by a single investor but shared by a group of investors (which psychologically makes people feel better; which is funny, yet true).

Further, more common sense came into play; a single stock investment can be risky because the profit and loss would solely depend on a single company’s performance. The single stock risk should be hedged and how to hedge without disturbing the original investment value of Rs.500 per investor? The solution was to add or bring more people into the group of investors. The number of investors or contributors should be increased from the current number of 20 to a million investors. So, it needed a professional company or an organization to manage the challenge and opportunity of bringing together more and more people as contributors towards the same cause or goal or objective.

Let’s say the professional company (also called as an Asset Management Company or a Mutual Fund House) worked hard and convinced one lakh people to contribute Rs.500 per person; the total corpus was Rs.5.00 crore (100000 people x Rs.500). Now the company has large funds at its disposal and discretion; the company has employed expert and skilled fund managers who are capable of research, analysis and investment management. They start identifying, researching and analyzing many stocks and select (approximately) 50 different companies and design stock portfolios that become fully diversified because of multiple sectors and multiple stocks with certain weights to each sector and stock.

Is the asset management company conducting its business at its own whims or is it working under any rules and regulations? Of course, the asset management company comes directly under the government’s regulations defined for mutual fund companies. A dedicated securities market regulator – Securities and Exchange Board of India (SEBI) oversees the mutual fund industry and all asset management companies must adhere to the rules, regulations and norms as prescribed by the regulator.

Different portfolios are thus designed to meet different investment objectives of different types of investors. We have to note that each investor is different with their risk and return expectations based on their risk-taking abilities viz. conservative, moderate, aggressive and ultra-aggressive. The portfolios offered meet such expectations of different investors.

This is a simple understanding of how mutual fund works.

CAN I VIEW A SAMPLE EQUITY PORTFOLIO DESIGNED BY A MUTUAL FUND CO.?

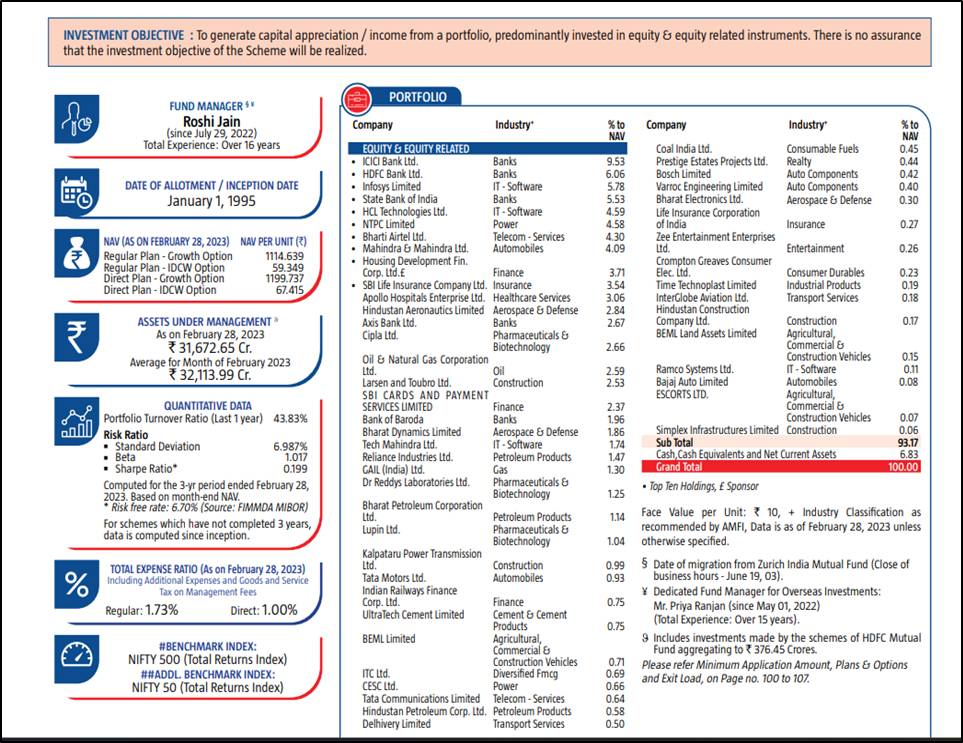

The typical portfolio of an equity scheme is illustrated below for easy understanding which has been sourced from the factsheet of a mutual fund house; the fund chosen here is managing in over Rs.31000 crore (savings mobilized from millions of investors) and has invested the money in several stocks as can be observed from the factsheet. There are a variety of stocks and sectors offering the required diversification which reduces the risk of single stock investment. Common investors need not have to select any stock on their own which responsibility is assumed by the fund house.

Since the minimum investment is pegged as Rs.500 per month and Rs.5000 as lump sum the entry-level investment makes investing sense making it a universal investment proposition.

More stocks in a portfolio nullifies single stock concentration and each stock supports the other stock in the portfolio during market volatility. The collective strength of the portfolio offers consistency and strength during different market circumstances.

Hence, mutual funds offer indirect entry into stock markets for common investors where the whole responsibility of managing the investor objective is entrusted to a professional asset management company. In India, as on 2023, there are 40 mutual fund companies (who have employed over 500 fund managers and over 1000 research analysts) managing over Rs.48 lakh crore worth of assets across equity and debt securities.

As a thumb rule, it is said that stock market performance reflects the performance of the economy; rising stock markets mirror sound and solid economic performance. Since 1991-92 Indian economy has grown tremendously which obviously every Indian is aware of, and so has been the growth of stock markets. The Sensex has grown from 3000 levels in 1991-92 to 67000 levels by 2023-24 mirroring the economic growth.

I AM A NEW INVESTOR IN MUTUAL FUNDS, HOW SHOULD I BEGIN MY INVESTING JOURNEY WITH MUTUAL FUNDS?

Before investing investors first must understand the categories of mutual fund schemes which will lead to proper selection of mutual funds. Without understanding categories, the objective of investing cannot be defined.

First, let us understand the categories of equity mutual funds.

| CATEGORIES | PORTFOLIO COMPOSITION |

| Index Funds | Passively managed portfolio; replicates the index stocks such as Sensex and/or Nifty 50 or any other indices chosen |

|---|---|

| Large Cap oriented funds | 80% of stocks from the large cap categorized list of stocks |

| Large & Mid Cap oriented funds | About 35% in large cap stocks, About 35% in mid cap stocks |

| Flexi Cap oriented funds | Stocks from across large, mid & small cap stocks without any minimum/maximum limits |

| Multi Cap oriented funds | About 25% exposure to large cap, mid cap and small cap stocks in the portfolio (each market cap category about 25% exposure) |

| Mid Cap oriented funds | About 65% stocks from the mid cap categorized list of stocks |

| Small Cap oriented funds | About 65% stocks from the small cap categorized list of stocks |

| Thematic Funds | Investing in specific themes such as infrastructure, housing, business cycles, consumption, banking & financial services etc. |

| Sectoral Funds | Investing in specific single sector such as pharma, FMCG, IT, Banking, Power etc. |

| Focused Funds | Investing in maximum of 30 stocks with focused approach as deemed right by the fund manager |

| Value Funds | Investing about 65% of the portfolio in undervalued stocks or identified as value stocks by the fund manager |

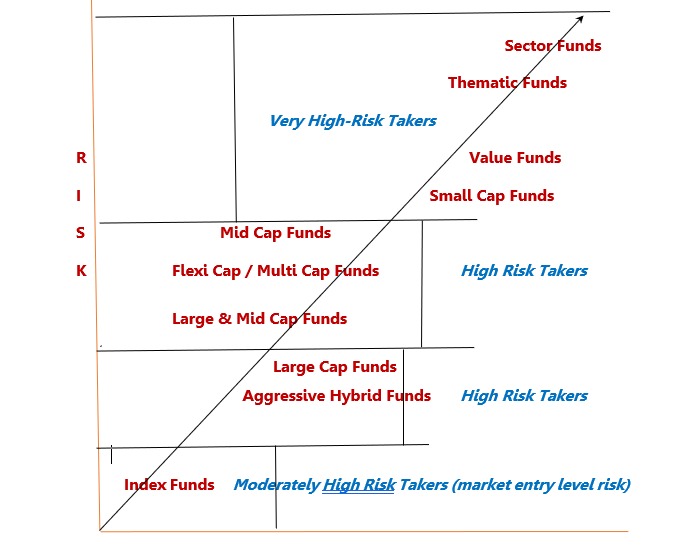

Every category of equity mutual fund is designed to meet the risk and return expectations of different types of investors. Each category has an underlying philosophy based on the stock picks and market capitalization tilt. In simple terms, large cap oriented funds’ risk is considered a tad below the risk of categories like Flexi-Cap, Mid-Cap, Small Cap, Value Funds and so on. Since a large cap oriented mutual fund has highest exposure to large companies, the risk is considered to be slightly lower than other categories. See the below indicative graphical representation of the risk hierarchy of equity oriented mutual funds for easy understanding as an investor.

INDICATIVE RISK HIERARCHY GRAPH OF EQUITY / HYBRID CATEGORIES

Investors can use the above graph and align their risk attribute with the category or categories and then choose accordingly. Understanding the underlying philosophy of a category is important before selecting any category to invest.

The decision to invest in mutual funds should start after clearly understanding the underlying objective of each of the categories designed which offers clarity. Randomly choosing categories is not the ideal method of investing. Similar to buying a colour of the dress that suits our style or body in which we might look good, or the combination of dresses we wear (top and bottom and even the footwear combination) that gives us a wholesome look, choosing categories too should be similar to this exercise or decision. Choosing a suitable combination of categories of equity mutual funds is essential to achieve successful investment outcomes.

WHAT ARE LARGE CAP, INDEX, MID CAP, SMALL CAP, MULTI-CAP ORIENTED AND OTHER TYPES OF EQUITY MUTUAL FUNDS?

One of the common categories of equity mutual funds is Large Cap Category mutual fund.

The term “Cap” here means “Capitalization” which is derived from the broader term “Market Capitalization.” Market Capitalization in simple terms means how much a company costs to buy outright which is calculated by multiplying the total equity shares issued by the price as quoted in the stock market. For example, the market capitalization of the company Wipro Ltd. during October 2023 was Rs.2 lakh crore (as per the equity shares issued multiplied by the market price), which means if someone wants to buy this company outright, they must pay Rs.2 lakh crore and buyout. A large cap classified company is respected by investors because of its size. The market capitalization of Reliance industries, the behemoth of the Indian stock market, was Rs.15 lakh crore getting all the respect it deserves due to its sheer size.

Similarly, every company listed and traded on stock exchanges is classified based on size and such sizes further get classified as Mid Cap and Small Cap besides already discussed Large Cap. We will learn about the mid and small cap stocks and mutual fund categories in our next learning episodes.

Based on this aspect of market capitalization the first 100 companies in descending order get classified as large cap stocks. In mutual funds, fund managers pick these first 100 companies as their “universe” and design a portfolio of large cap-oriented funds termed Large Cap Funds. On an average, from the available 100 large cap stocks they pick about 40 stocks as part of their portfolio; a large cap oriented portfolio usually has 40 to 60 stocks out of which 80% of the stocks are from the large cap universe and the rest 20% from the mid and small cap stocks universe.

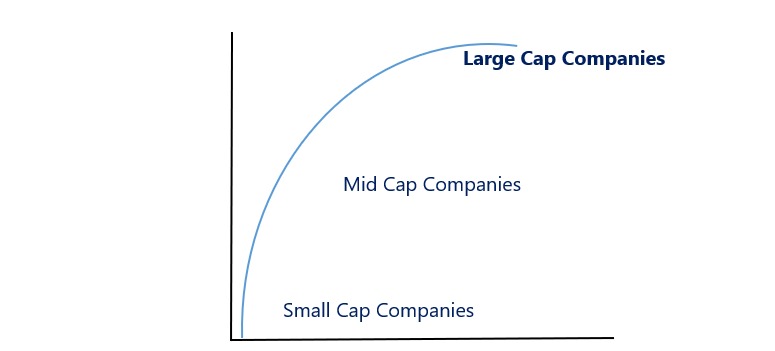

For a better understanding of the market capitalization that defines large, mid and small cap let’s draw a graph and observe what the size of companies means and how it leads to the simplicity of picking the right category of equity mutual funds by common investors with confidence.

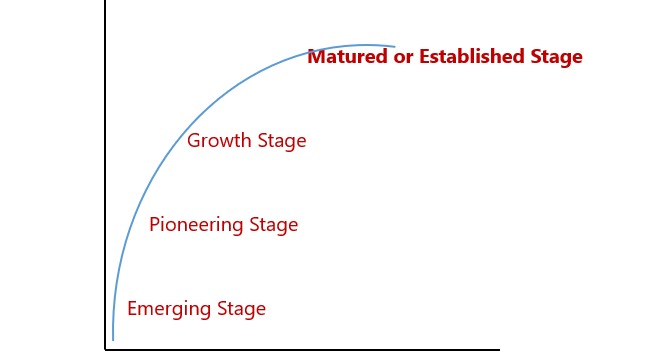

It is common sense to understand that every company starts small and over the future years they grow and become big or at least the companies will be in pursuit of growing big; the purpose of starting a business, any business, is to make it grow bigger and bigger. But growing big is not an overnight process, it takes several years.

In simple terms, what is a large company today would have definitely been a small and a mid sized company many years ago and with the efforts of the promoters, management and other conducive environments, the company would have grown big.

We can map the stages of companies in this manner (observe the graphical representation)

These phases or stages of companies are measured through the term called Market Capitalization; let’s now see another graph as an extension of the above graph:

Learning from the above graphs

It is simple now to understand that companies at the emerging stages can be risky because they have yet to test or experience the next levels of growth which may sound improbable at this juncture. However, the companies at the matured or established stages have already gone through the phases or stages of growth and seem to be less risky.

It is common that most investors prefer to bet on companies that have matured and are at the top of the growth curve; these companies have established businesses and a defined market share and the company’s quantitative (financial metrics) and qualitative attributes (management capabilities) are well known for analysis.

Based on these aspects the sizes of companies as measured by the market capitalization get classified as Large Cap, Mid Cap and Small Cap stocks. The first 100 companies from the highest to the lowest market cap are Large Cap Companies, 101 to 250 are Mid Cap Companies and 251 onwards all companies get default classification as Small Cap Companies.

Based on the classification of each company the portfolios are designed. A large-cap oriented mutual fund will have about 80% of the portfolio invested in large-cap companies while a mid-cap oriented mutual fund will have about 65% of the portfolio invested in medium-sized companies while a small-cap oriented mutual fund will have about 65% of the portfolio invested in small-sized companies and a multi-cap oriented fund will have almost equal percentage exposure to all three sized companies such as large, mid and small cap companies.

All equity mutual fund portfolios will by and large comprise of stocks from all market caps with different proportions that suit the specific portfolio objective.

WHAT ARE LARGE CAP FUNDS?

As per the SEBI rule any large cap oriented equity fund portfolio should have at least 80% of the stocks that are classified as large cap (from the first 100 companies). For example, if the portfolio has 50 stocks, 40 stocks should be from the large cap space and the balance 10 stocks can be from the mid and small cap space.

PORTFOLIO COMPOSITION OF TYPICAL LARGE-CAP ORIENTED FUNDS

| Market Cap Exposure Matrix | ||||

| Fund Name | Large Cap Stocks | Mid Cap Stocks | Small Cap Stocks | Total |

| ABSL Frontline Equity Fund | 89% | 11% | 0% | 100% |

|---|---|---|---|---|

| Axis Bluechip Fund | 98% | 2% | 0% | 100% |

| Bandhan Large Cap Fund | 93% | 3% | 4% | 100% |

| DSP Top 100 Fund | 88% | 12% | 0% | 100% |

| HDFC Top 100 Fund | 94% | 6% | 0% | 100% |

| ICICI Pru Bluechip Fund | 91% | 8% | 1% | 100% |

| Kotak Bluechip Fund | 85% | 14% | 1% | 100% |

| Nippon India Large Cap Fund | 86% | 11% | 3% | 100% |

| SBI Bluechip Fund | 88% | 12% | 0% | 100% |

| UTI Mastershare Fund | 89% | 10% | 1% | 100% |

Every mutual fund has a market capitalization matrix that showcases the composition of the portfolio. A large cap portfolio composition can be identified through exposure to different market cap stocks which can be usually found through the fund factsheets of the mutual fund houses. A large cap category fund should have a minimum of 80% of its portfolio invested in large cap stocks picked from the top 100 large cap stock universe. (See the above illustration table)

As can be observed from the above matrix of market capitalization exposure it can be noticed that all the funds illustrated have more than 80% invested in large cap stocks and the balance invested in mid and small cap stocks. Some funds have completely ignored small cap stocks with an intention to maintain the portfolio with a higher exposure to large cap stocks. Such decisions are at the discretion of the fund managers

How do I identify a large cap oriented fund? Every mutual fund company offers large cap oriented category scheme; this category is among the most common offering by any mutual fund house. One must be able to identify large cap category funds of mutual fund houses. Below is the list of large cap mutual fund schemes of the top 10 mutual fund companies:

| FUND HOUSE | FUND NAME |

| Aditya Birla Sun Life Mutual Fund | Aditya Birla SL Frontline Equity Fund |

| Axis Mutual Fund | Axis Bluechip Fund |

| Bandhan Mutual Fund | Bandhan Large Cap Fund |

| DSP Mutual Fund | DSP Top 100 Fund |

| HDFC Mutual Fund | HDFC Top 100 Fund |

| ICICI Prudential Mutual Fund | ICICI Pru Bluechip Fund |

| Kotak Mutual Fund | Kotak Bluechip Fund |

| Nippon India Mutual Fund | Nippon India Large Cap Fund |

| SBI Mutual Fund | SBI Bluechip Fund |

| UTI Mutual Fund | UTI Mutual Fund |

Such information can be sought from respective mutual fund house websites and their respective fund factsheets. An investor has to identify a large cap category fund and from the name of the fund at times it may not be easy to identify; for example, Aditya Birla Sun Life Frontline Equity Fund is the name of the large cap oriented fund offered by Aditya Birla Sun Life Mutual Fund which must be understood before choosing and investing; another example is UTI Mastershare Fund which is a large cap fund and without knowing that this fund is large cap oriented it may be difficult to identify. Mutual fund distributors such as Phundo Fintech may assist the investor through their knowledge and expertise.

How to choose the correct large cap fund to invest in? By and large common investors prefer to choose mutual funds through their performances; any fund that has given the highest returns in a particular period of time investors presume that such funds are good and should be chosen for investing. But such decisions can be wrong leading to the wrong selection of funds. Returns should not be the only parameter to judge or select any mutual fund scheme. There are other factors too that can be considered.

Here, the research expertise of Phundo will help investors in choosing the right set of large cap funds.

Who should choose a large cap oriented fund? Such investors who do not want to take higher risks by exposing their investment into mid and small cap stocks, which are considered as riskier than large cap stocks, should ideally choose large cap funds.

How long to stay invested? All equity oriented investments are designed for long-term holding which ideally should be five years and more, longer the better to achieve the best outcomes.

How many large cap funds should I have in my portfolio of mutual funds?

One large cap fund should be fine; for example, if you are investing Rs.5000 as lump sum you can choose only one large cap fund or if you are investing Rs.1000 through the SIP mode again only one large cap fund is enough. If you are investing Rs.10000 two categories of funds can be chosen; for example: Rs.5000 in a large cap oriented fund and another Rs.5000 in any other category fund which would enhance your return generating quotient. (You will learn about other categories of equity mutual funds later)

Too many funds in the overall portfolio should be avoided which will become difficult to track and keep account of.

WHAT ARE INDEX FUNDS?

Index funds are simple to understand and can be invested by almost every type of investor (here type of investor refers to the risk-taking ability of the investor). Index here refers to the indices offered by the stock exchanges that showcase the pulse or trend or the direction of the stock market. If markets are rising or falling or being volatile is displayed through the movement of an index.

There are two stock exchanges in India – The Bombay Stock Exchange (BSE) and The National Stock Exchange (NSE) in which thousands of companies are listed and traded every day. Each stock has a price that oscillates based on various factors such as fundamental attributes, demand & supply and sentiments of the participants. The prices of stocks rise and/or fall or remain unchanged or display high volatility which makes the market to be unpredictable.

Such movements of the market are tracked through indices and both the stock exchanges have provided various indices among which the main indices Sensex and Nifty 50 are renowned and much followed by all the market participants.

Sensex belongs to Bombay Stock Exchange and Nifty 50 belongs to National Stock Exchange. Sensex as the main index comprises of 30 large companies and Nifty 50 as the main index comprises of 50 large companies selected based on certain parameters as per the rules of the exchanges. The constituents of the index are reviewed once in six months and if found necessary the stocks would be shuffled but the number of stocks in the index remains unchanged.

Below is the table of Sensex 30 companies and Nifty 50 Companies

| SENSEX 30 COMPANIES | ||

| Sl. No. | Company Name | Industry |

| 1 | Asian Paints Ltd | Paints |

| 2 | Axis Bank Ltd | Banking |

| 3 | Bajaj Finance Ltd | Financial Services |

| 4 | Bajaj Finserv Ltd | Financial Services |

| 5 | Bharti Airtel Ltd | Telecommunication |

| 6 | HCL Technologies Ltd | IT |

| 7 | HDFC Bank Ltd | Banking |

| 8 | Hindustan Unilever Ltd | FMCG |

| 9 | HDFC Ltd. | Financial Services – Housing Loan |

| 10 | ICICI Bank Ltd | Banking |

| 11 | IndusInd Bank Ltd | Banking |

| 12 | Infosys Ltd | IT |

| 13 | ITC Ltd | FMCG |

| 14 | Kotak Mahindra Bank | Banking |

| 15 | Larsen & Toubro Ltd | Engineering |

| 16 | Mahindra & Mahindra Ltd | Automobile |

| 17 | Maruti Suzuki India Ltd | Automobile |

| 18 | Nestle India Ltd | FMCG |

| 19 | NTPC Ltd | Power |

| 20 | Power Grid Corp | Power |

| 21 | Reliance Industries Ltd | Diversified |

| 22 | State Bank of India | Banking |

| 23 | Sun Pharma | Pharma |

| 24 | TCS | IT |

| 25 | Tata Motors Ltd | Automobile |

| 26 | Tata Steel | Steel |

| 27 | Tech Mahindra | IT |

| 28 | Titan | Retail |

| 29 | Ultratech Cement | Cement |

| 30 | Wipro | IT |

| NIFTY 50 COMPANIES | ||

| Sl. No. | Company Name | Industry |

| 1 | Adani Enterprises Ltd. | Diversified |

| 2 | Adani Ports and Special Economic Zone | Ports and Shipping |

| 3 | Apollo Hospitals Enterprise Ltd. | Healthcare |

| 4 | Asian Paints Ltd. | Paints |

| 5 | Axis Bank Ltd | Banking |

| 6 | Bajaj Auto Ltd. | Automobile |

| 7 | Bajaj Finance Ltd. | Financial Services |

| 8 | Bajaj Finserv Ltd. | Financial Services |

| 9 | Bharat Petroleum Corporation Ltd. | Oil & Gas |

| 10 | Bharti Airtel Ltd. | Telecommunication |

| 11 | Britannia Industries Ltd. | FMCG |

| 12 | Cipla Ltd. | Pharma |

| 13 | Coal India Ltd. | Oil & Gas |

| 14 | Divi’s Laboratories Ltd. | Pharma |

| 15 | Dr. Reddy’s Laboratories Ltd. | Pharma |

| 16 | Eicher Motors Ltd. | Automobile |

| 17 | Grasim Industries Ltd. | Cement |

| 18 | HCL Technologies Ltd. | IT |

| 19 | HDFC Bank Ltd. | Banking |

| 20 | HDFC Life Insurance Company Ltd. | Financial Services – Life Insur |

| 21 | Hero MotoCorp Ltd. | Automobile |

| 22 | Hindalco Industries Ltd. | Metals & Mining |

| 23 | Hindustan Unilever Ltd. | FMCG |

| 24 | HDFC Ltd. | Financial Services – Hsg. Loan |

| 25 | ICICI Bank Ltd. | Banking |

| 26 | ITC Ltd. | FMCG |

| 27 | IndusInd Bank Ltd. | Banking |

| 28 | Infosys Ltd. | IT |

| 29 | JSW Steel Ltd. | Steel |

| 30 | Kotak Mahindra Bank Ltd. | Banking |

| 31 | Larsen & Toubro Ltd. | Engineering |

| 32 | Mahindra & Mahindra Ltd. | Automobile |

| 33 | Maruti Suzuki India Ltd. | Automobile |

| 34 | NTPC Ltd. | Power |

| 35 | Nestle India Ltd. | FMCG |

| 36 | Oil & Natural Gas Corporation Ltd. | Oil & Gas |

| 37 | Power Grid Corporation of India Ltd. | Power |

| 38 | Reliance Industries Ltd. | Diversified |

| 39 | SBI Life Insurance Company Ltd. | Financial Services – Life Insur. |

| 40 | State Bank of India | Banking |

| 41 | Sun Pharmaceutical Industries Ltd. | Pharma |

| 42 | TCS | IT |

| 43 | Tata Consumer Products Ltd. | FMCG |

| 44 | Tata Motors Ltd. | Automobile |

| 45 | Tata Steel Ltd. | Steel |

| 46 | Tech Mahindra Ltd. | IT |

| 47 | Titan Company Ltd. | Retail |

| 48 | UPL Ltd. | Chemicals |

| 49 | UltraTech Cement Ltd. | Cement |

| 50 | Wipro Ltd. | IT |

It can be observed from the list of both indices that the names of the companies are well-known and acclaimed which even common people would have heard of them. Moreover, the products and services of these companies are used by almost everyone making it simple to understand the underlying strength of these companies.

We can even observe the diversification of industries or sectors; the sectors represent the important industries of the Indian economy.

It would be natural for any investor, particularly such investors who are new (entry-level) to investing in equities, to feel more secure by choosing to invest in large (established) companies.

The fund managers of the mutual fund houses design index portfolios that are exactly a replica of the index (Sensex and/or Nifty 50) which are called as Index Funds; they do not actively manage such portfolios but mimic the performance which means if the index (Sensex or Nifty 50) rises the value of the index fund too rises and if the index (Sensex or Nifty 50) falls the value of the index fund too falls thereby offering simple understanding of the performance of the investment done by investors in index funds.

Examples of Index Funds: Almost every mutual fund house offers index funds; most common index funds are illustrated below:

| Fund House | Fund Name |

| Bandhan Mutual Fund | Bandhan Nifty 50 Index Fund |

|---|---|

| DSP Mutual Fund | DSP Nifty 50 Index Fund |

| Franklin India Mutual Fund | Franklin India NSE Nifty 50 Index Fund |

| HDFC Mutual Fund | HDFC Index Fund Nifty 50 Plan / HDFC Index S&P Sensex Plan |

| ICICI Prudential Mutual Fund | ICICI Pru Nifty 50 Index Fund |

| Nippon India Mutual Fund | Nippon India Index Nifty 50 Fund / Nippon India Index S&P Sensex Fund |

| Tata Mutual Fund | Tata Nifty 50 Index Fund |

| UTI Mutual Fund | UTI Nifty 50 Index Fund |

The returns generated from the respective index funds would be similar to the performance of the index (Nifty 50 and Sensex) for the given periods. For example, if HDFC Index Fund Nifty 50 Plan has generated 13.00% returns over a 10 year period, it means the actual Nifty 50 index would have generated almost the same returns over the same period.

Another information about index funds is that these funds have lower expense ratios compared to actively managed funds; since index funds are not actively managed the expenses or cost to manage and maintain the portfolio is less and hence these funds charge lower expenses. For example, actively managed equity funds may charge expense ratios of up to 2% per annum while index funds may charge as low as 0.30% making it cheaper in terms of investment cost.

At the same time, it does not mean that low expenses can be beneficial to investors under all circumstances.

For example,

Investor – A chose an index fund and invested Rs.10000 ten years ago; after 10 years at 12% annualized compounded returns his investment value grew to Rs.31000 (after accounting for an expense ratio of 0.30% charged to the fund/NAV by the fund house).

Investor – B chose an actively managed mid cap oriented mutual fund and invested Rs.10000 ten years ago; after 10 years at 18% annualized compounded returns his investment value grew to Rs.52000 (after accounting for an expense ratio of approx. 1.75%).

By choosing index fund Investor – A lost out on Rs.21000 additional profit which he could have earned had he chosen a diversified actively managed fund.

The moral of the learning is that one cannot invest in a mutual fund only for the purpose of saving on the expense ratio.

The bottom line is that Index funds are simple to understand that reflect the market performance and no need to worry about any other stocks’ performance outside the box of index stocks. Since the stocks are all from the top list of companies based on their size, it offers the comfort of taking risk for certain profiles of investors.

SHOULD I CHOOSE LUMP SUM OR SYSTEMATIC INVESTMENT PLAN?

The choice of the mode of investment is always based on the cash flow situation of investors. If you are salaried and getting a stable monthly income SIP would be ideal; if you are in business or a profession where your income is not monthly or have access to lump sum savings, then choosing lump sum would be better. SIP is a disciplined commitment for longer periods of time hence having a steady cash flow would be important and critical to meet the goals for which investment is being done. One can choose both SIP and lump sum mode of investing based on the availability of funds at their disposal.

SHOULD I CHOOSE THE GROWTH OPTION OR DIVIDEND OPTION (INCOME DISTRIBUTION AND CAPITAL WITHDRAWAL OPTION)?

Growth option is similar to a cumulative fixed deposit where the depositor will take out the principal and the interest accrued at the time of maturity. In mutual funds too if the investor does not want to encash or receive the growth portion of the Net Asset Value during the course of staying invested then Growth Option should be chosen. Growth option allows compounding of the investment better since the growth of the NAV continues to get reinvested based on the market (fund) performance. One has to note that some equity funds’ NAV over 25 years have grown from Rs.10 to over Rs.1000 which mirrors the possibility of not withdrawing the profit in-between

Dividend or IDCW option is ideal only for such investors who seek income from investments to augment their cash flow such as retirees. Investors between the age group of 21 and 60 should strictly avoid choose dividend or IDCW option.

CAN I BOOK PROFITS WHEN MY INVESTMENT HAS GROWN?

Definitely a bad idea; investments in mutual funds are done to create wealth and not to book profits. Profits are booked by traders and speculators but wealth is created by long term investors. At the time of investing itself a specific goal of what to achieve should be chosen and an investor should stick to the goal or stick to the period of investing chosen.