Update

Update

On 1st February Nirmala Sitaraman India’s Finance Minister presented her second budget. In our view, a budget presentation should be treated as a non-event just as in the case of other countries globally. This, however, is not the case in India. Budget sessions are viewed where Big Bang announcements are made and this time round like last year the longest ever speech by Sitaraman was a disappointment to most folks!

It seems to us that Prime Minister Modi is attempting to change this behavior. In 2019, the budget presentation disappointed many with no “killer instinct” as stated by many industry experts. But during the year, several announcements were made to address the economic slowdown and one that was believed to be revolutionary was the reduction in corporate tax rates.

We took a step back from the noise and believed that the budget was fantastic for long term Mutual Fund investors. The dividend distribution tax (DDT) has been abolished at both the company and Mutual Fund levels. Instead, dividends will be taxable in the hands of investors.

For Mutual Funds, dividends declared by companies in the earlier regime were subject to DDT at the rate of 20.56%. This implied that Rs 100 dividend declared was subject to Rs 20.56 under DDT to the Mutual Fund making a net payout of Rs 79.44. Under the new guideline effective from 1st April 2020, companies will not deduct Rs 20.56 and instead payout Rs 100 to the Mutual Fund.

Based on discussions with AMCs, abolishing of DDT is a huge benefit for equity Mutual Funds. Mutual Funds are exempt from tax and hence, the change in DDT will improve returns. Another point to note is that fund managers will actively look at higher dividend-yielding companies to invest in. This changes the way we invest. Value investing will become a strong proposition going forward where fund managers will view their investment decisions as a “buy and hold” strategy as opposed to high turnover in the portfolios.

Finally, our advice on investing in growth options has been vindicated. We always believed that using the dividend payout/reinvestment options were inefficient ways of creating liquidity in portfolios. Instead, we built portfolios in growth options with a systematic withdrawal plan (SWP) to create liquidity. Investors who continue to remain in the dividend reinvestment or payout plans will be subject to paying out the tax as per their marginal tax rate. Therefore, if you receive Rs 100 as dividends from an equity Mutual Fund and your tax rate is 20% then you will need to add Rs 20 to your total income and compute your tax liability at the end of the financial year. You are worse off in choosing dividend options in Mutual Funds.

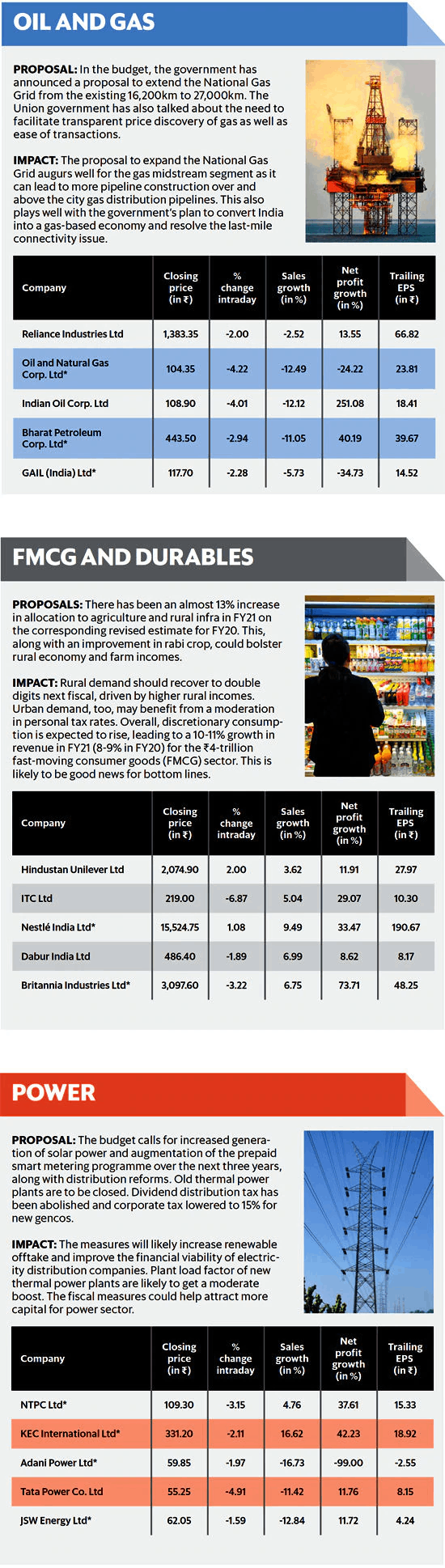

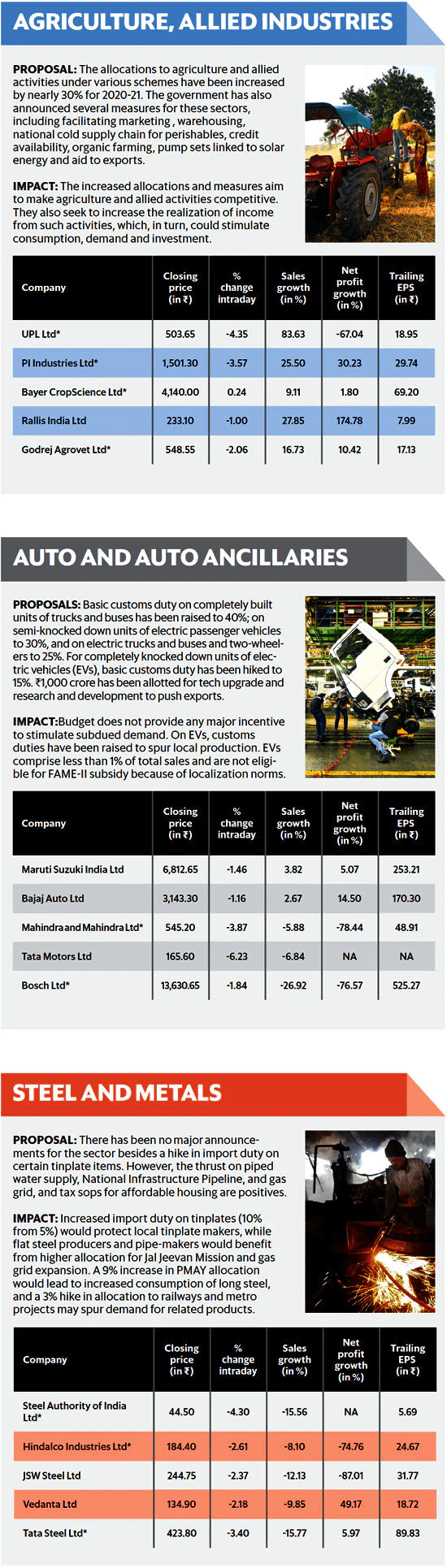

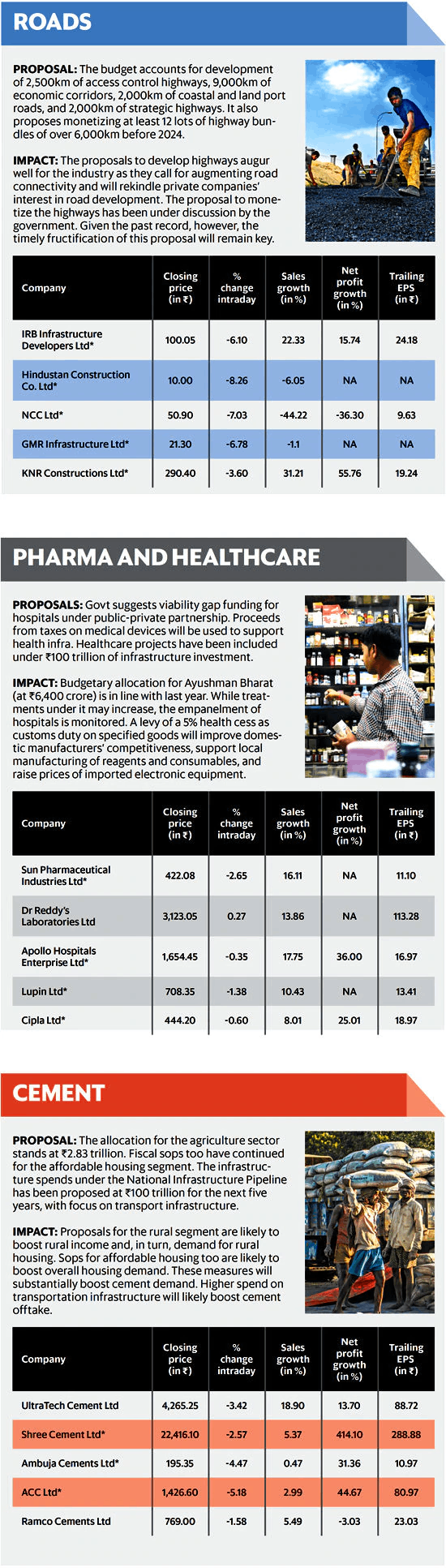

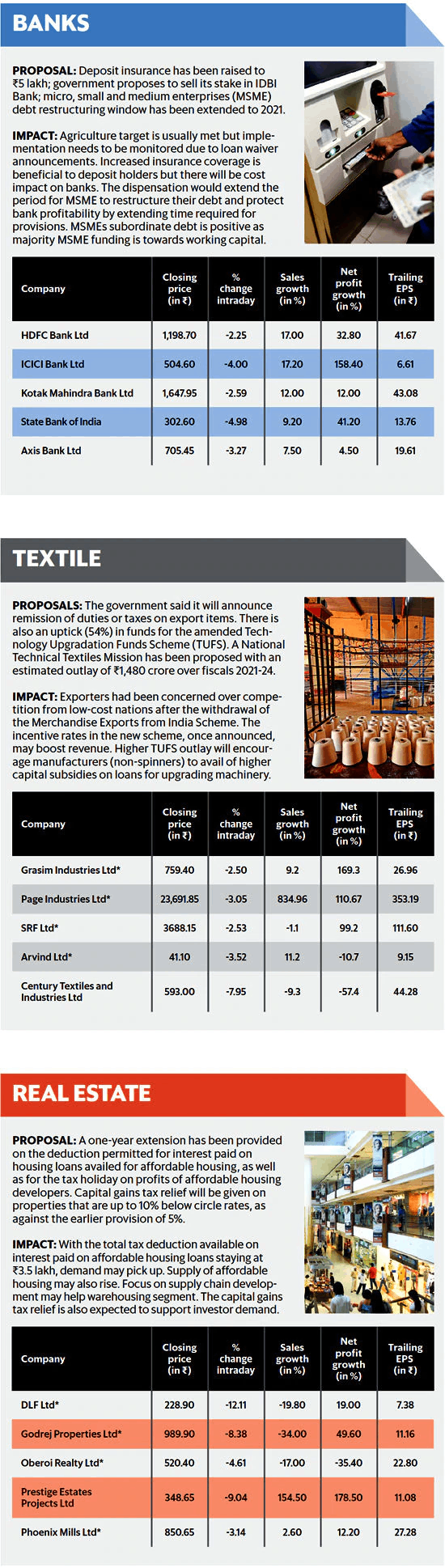

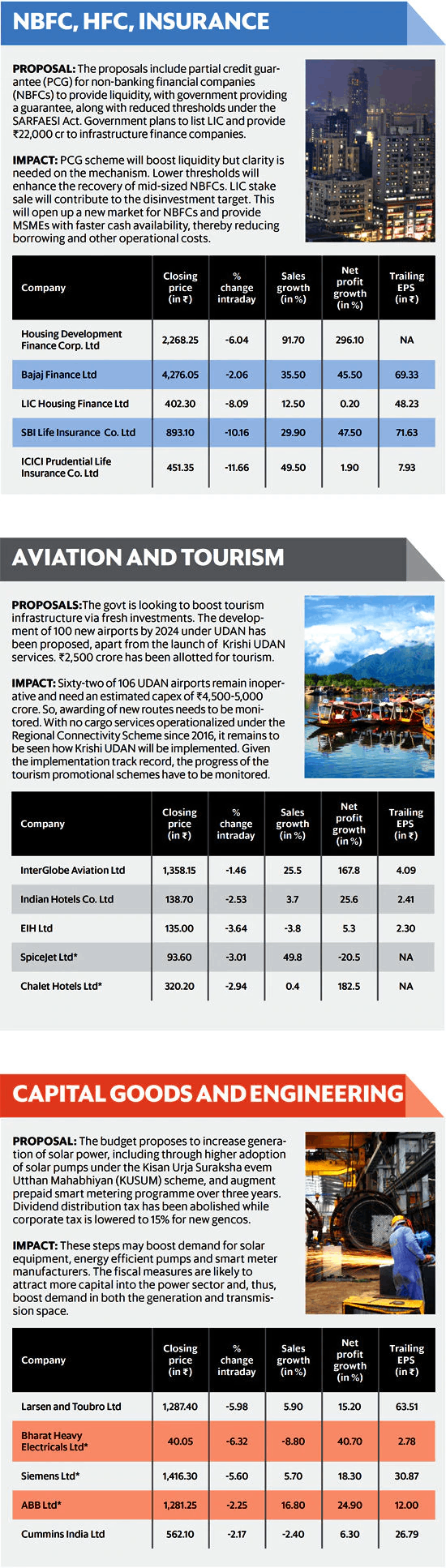

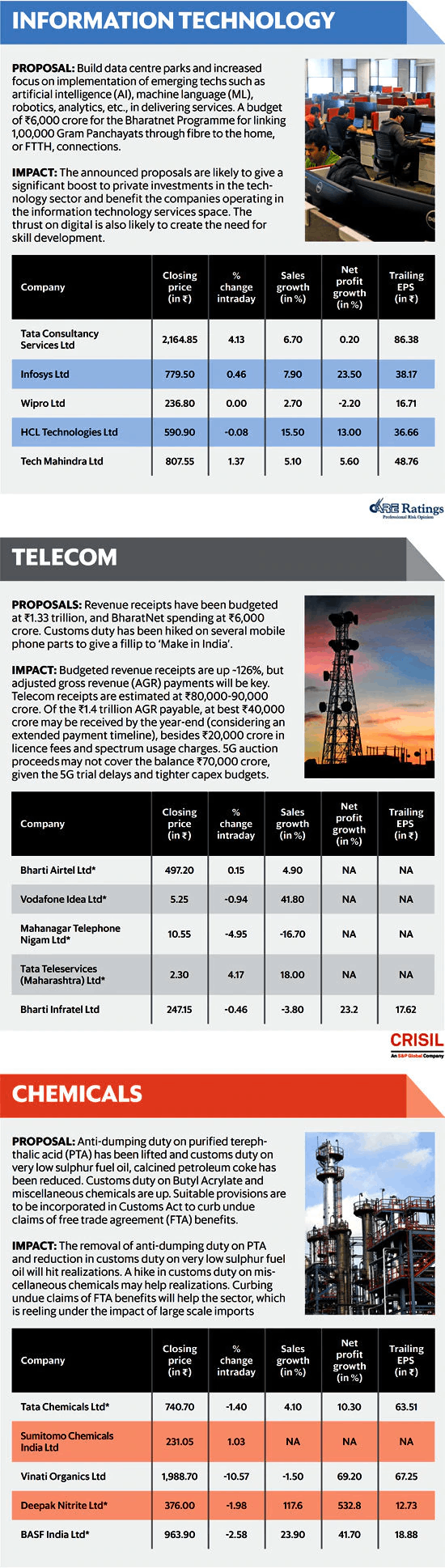

Now lets discuss key areas of the budget. Mint, in its detailed analysis of the budget, included an insightful opinion on the impact of industry segments. We provide below this overview for your reference: -

In terms of a quick summary we provide below our forward analysis :-

a) Quality stocks are trading at their lowest values. Discussions with fund managers and research teams in the past quarter lead us to believe that this is creating a strong buy opportunity.

b) Budget or no budget, good Indian companies will continue to grow and invest. The reduction in corporate taxes is improving operating bottom lines and we believe that this will finally play out on valuations.

c) Abolishing DDT takes away the problem of double taxation at the company level. Further, it provides a level playing field for the foreign portfolio managers for investing in India in comparison to elsewhere.

d) Removal of DDT will help Mutual Funds in improved yields, push fund managers to look at higher dividend-yielding companies and reduce the overall portfolio churn.

As an investor, what must you do :-

a) Review your portfolio and allocate to "value funds".

b) Move away from dividend payout/reinvestment to growth options.

c) Invest in the long-term. Higher dividend-yielding companies will deliver strong returns over a 5 years investment horizon.

At Phundo our portfolios are designed to address the above three opportunities. So, SELECT INVEST RELAX with Phundo.com.

Mutual Funds are subject to market risks, please read the offer document and consult your advisor before investing.