Update

Update

The BIG BANG theory is a leading explanation of how the universe began. In simple terms, it says that the universe started with a small singularity that inflated over the next 13.8 billion years to the cosmos as we know it today.

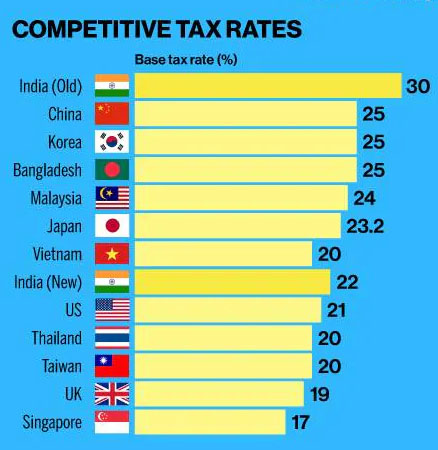

On 19 September 2019, the government announced a decision reminiscent to that of the BIG BANG theory. With one stroke India turned 360 degrees in acceleration mode, from being the highest corporate tax rate to now one of the lowest globally.

India reduced corporate tax (base rate) from 30% to 22% for the domestic industry. Besides, any company setting up a manufacturing base post 01 October 2019, will be charged 15% corporate tax as an added booster. This move has made the Indian industry competitive with the government signalling to global players to set up base and make in India. At 15% (effective rate 17%) India now stands at the same rate as Singapore and well below the Asian competitors of Taiwan, Thailand, China, Vietnam, Malaysia, Korea and Bangladesh.

How do we view this decision? VERY POSITIVE. But when we evaluate investment decision making, we need to be cautiously optimistic. The government has shown it animal spirit in this announcement as well as several others, for example, imposing anti-dumping duties on steel or removing import duties on EDC and Ethylene both of which will support domestic steel and plastic manufacturers respectively. The question is whether the private enterprise will have the courage to now boost investments, spur demand and innovate with higher commitments towards R & D.

To de-construct, this move and help in your decision making we believe that the sentiment has turned in favour of investing in India. Yet at the same time, we need to have a measured approach with the discipline to stay the course and here is why :

a) Impact on the economy :

The is no doubt that India now stands at competing with other Asian countries on most fronts. Industry leaders have been demanding tax rationalization to compete at a global scale. Equity markets rebounded at this move with FII increasing their risk towards India stocks. But structural imbalances will not be resolved overnight. It will take time for the economy to rebound back towards growth, consumption, demand and investment. Much of this remains both in the hands of the government as well as at the doorstep of private enterprise.

b) Impact on capital markets :

Indeed, the decision by the government was hailed as yet another major economic reform by equity markets. Overnight indices covered up the losses it had made in the first quarter of the fiscal year. On the other hand, the debt markets were turbulent as 10-year yield rebounded from 6.62% to close at 6.79%. Most debt funds were hit with a NAV loss overnight with 22 funds experiencing a one-day loss of over 1%. The debt market viewed this decision negatively with the government expected to lose Rs 1.42 lakh crores in revenue with these tax cuts, hence possibly breaching the fiscal deficit target of 3.3% of GDP for FY 2020.

c) On investment behaviour :

Uncertainty is certainly the killer to investment decision making. Yet, if you play your cards well, uncertainly can be your best friend. The best and most effective way to deal with uncertainty is to have a disciplined approach to investing. This approach along with diversification becomes two of the most powerful weapons to build a sustainable and steady mutual fund portfolio.

India is experiencing the building of its Cosmos which started with one small singularity call "killer instinct" that will allow a lot more bigger announcements to take this country forward in the long-term.

Two strategies will always work in the mid-to-long-term. The first - invest in corporate debt (not dynamic bonds or long-dated Gsec and corporate bonds). The second - invest in multi-cap funds. Both strategies allow the experts – fund managers, research specialists and risk management teams to structure the portfolio in a manner to increase returns and improve downside risk protection measure.

At Phundo, we are constantly engaging with the experts regularly thereby providing you with a basket of the most suitable products for your investment needs. SELECT INVEST RELAX the Phundo.com way!