Update

Update

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Markets have seen a fair amount of volatility in the past few weeks. As we continue our journey which started in April this year, we have been meeting investors from across India. We have been able to put our views across to the NRI community as well. We are encouraged at the response and the level of interest expressed by investors. This interest has motivated us to come up with a note focused on simple investment solutions as the best driver to building sustainable long-term portfolios.

This year 2018, has been a year that appears to differentiate the men from the boys. Equity markets broke all records to touch new highs and inflows continued across investment strategies – PMS and equity mutual funds. In our earlier blog (When Fixed Income Rocks Equity Markets) we had touched upon issues of the rout in debt and equity markets with Phundo’s recommendation on the next steps.

As concerns of non-banking financial institutions simmered to the surface, portfolio managers (in specific those managing Portfolio Management Services or PMS) started feeling the heat. Equity assets of over US$ 13 billion or Rs 96,000crs lost an average of 10% based on information received from our sources.

Whether you choose to invest in direct equities, use a portfolio management service (PMS) platform to channel your money or invest in equity mutual funds, the end objective remains the same – make your money work harder for you.

In the past few weeks, we have been approached by investors asking our opinion on which is the best route to build a sustainable, high return investment portfolio. This note helps decipher the mysterious codes around PMS which we hope will assist investors in choosing the right investment vehicle on a risk v/s reward basis.

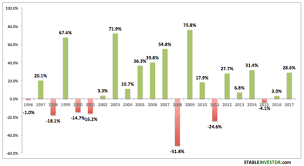

Before we get into addressing concerns around PMS, lets highlight the impact of the Nifty index over the past two decades –

The Nifty has delivered positive returns in 15 of the 22 years. Understandably, investors looked at alternatives to improve their returns hence, interest in portfolio management services (PMS) built up. Today the AUM of PMS stands are approximately Rs 1 lakh crores.

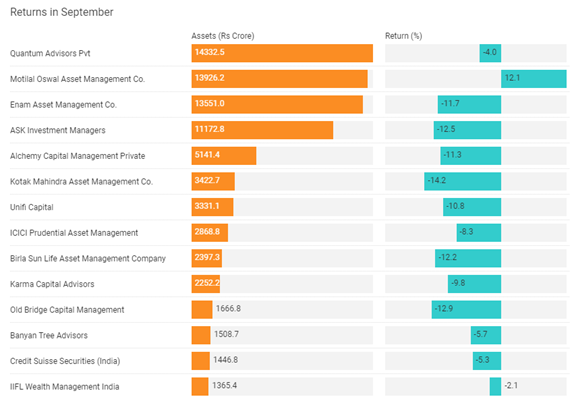

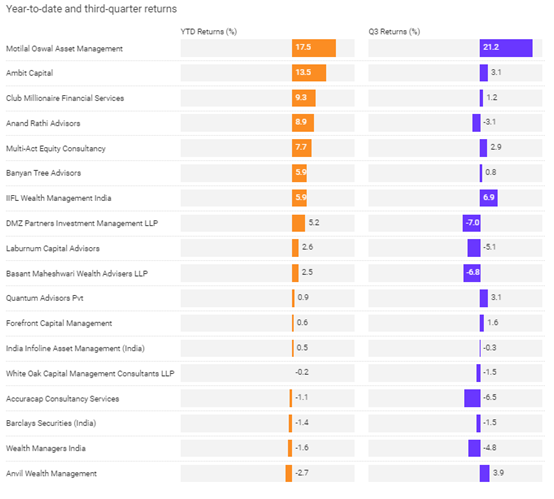

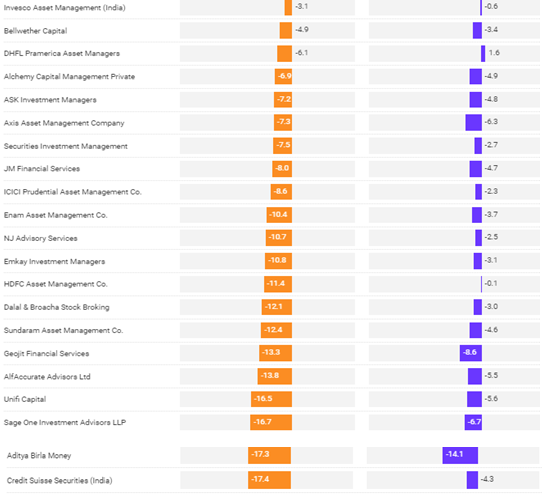

How did portfolio managers perform when markets hit a rough patch as we have seen in September 2018?

As rising oil and weaker rupee weighed on sentiments, the average fall of PMS products is higher than the Nifty 50’s decline of 6.42% in September, the most in a month since February 2016. This implies that if you had invested in a mutual fund with a large concentration of the Nifty 50s stocks – simple, plain, vanilla investment products - you would have been better off than investing in exotic investment strategies such as PMS.

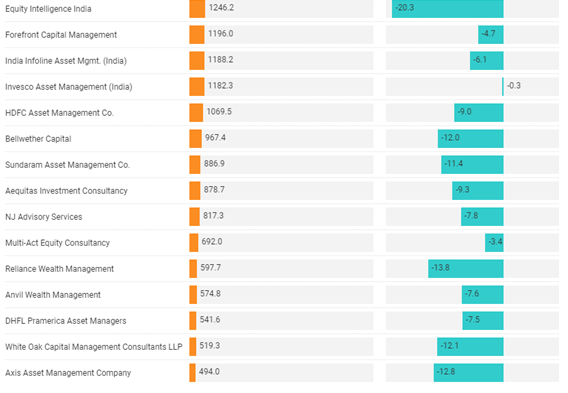

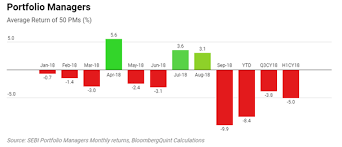

One would question on being selective in our analysis by reviewing the data for September 2018, the month of many market driven events so far. To address this concern, we looked at the gains / losses on a YTD basis for both PMS and Nifty 50s (benchmark used by active mutual fund managers).

No doubt that the Nifty 50s have also erased the year’s gain and is down by 1.73% from its average. But in comparison, PMS returned a negative of 8.4% on an average with just about a handful of PMS products returning gains on a year-to-date basis.

The below figure provides the gains / losses on a year-to-date basis for PMS:-

PMS has always been positioned as an investment medium that suits high-class investors who are commonly termed as High Net-worth Individuals or HNIs. The minimum investment in a PMS is not less than Rs.25 lakhs while the minimum investment in equity mutual funds is as low as Rs.5000 and in some cases even lower. Now how does a PMS investor benefit from a higher threshold limit? Sales people who offer and promote PMS investment propositions claim that the investor would get “personalized” service,yet nobody knows how exactly this is given or who exactly will give that service; the salesperson or the portfolio manager?

Investors need to ask tough questions such as; Do I need personalization or returns? Am I paying for consistency or volatility? Do I need higher level of transparency or am I happy with the extent of information provided on the underline securities?

Phundo has put together a ready reckoner of the differentiation between a PMS and an equity mutual fund.

So next time you choose an investment strategy, always ask all the right questions. Reach out to us at support@phundo.com for more insights and advise.

SELECT, INVEST and RELAX the PHUNDO way.www.phundo.com

Disclaimer: Mutual Fund investments are subject to market risks. Please read offer document before investing. Past performance does not indicate future returns.