Update

Update

In January 2019, we had published a blog titled "Fire and Fury", a story on the trade relations between the US & China and its impact on global economies. We followed up this blog with insights into investing in European companies titled "European Champions". Both stories were aimed at analyzing events outside India and the likely impact that this could have on valuations globally. India is not insulated from such events.

But let’s step back a bit. Events are often sensationalized, characterized that the world is coming to an end. Much like the state of affairs in the Indian economy which by the way will reverse, a question is when. Questions around valuations of equities surrounds us. So to deconstruct the valuation story I have picked a company, a global leader which has its roots in China. Controversial isn't it? A Chinese company, global appeal, etc, etc. No, it has nothing to do with the telecom industry which has seen the rise of Huawei and Xaiomi taking on brands like Apple and Samsung.

Ma Yun a.k.a Jack Ma the founder of e-commerce giant Alibaba and a stakeholder in Alipay is officially the richest person in China with a net worth of US$ 25 billion on the recent US$ 150 billion IPO filing. Alibaba is the sixth-largest company in the world in terms of market cap, and processes goods more than eBay and Amazon combined! “Wow!! This must be an expensive stock to buy?” asked one of my investors interested to buy Alibaba’s shares listed on the Hong Kong exchange. Hence, this background to this note pushed by feedback on investing in global stocks as part of a diversification strategy.

One must keep in mind that investing in developed equity markets comes with a variety of structures, complicating an understanding of determining the price of the stock – is it expensive or cheap? This note is to attempt to help in understanding valuation structures using ADR concept as an example.

To understand valuation, we first need to mention that Alibaba shares come in two structures – American Depository Receipts denominated in US$$ (ADR) and direct listing on the Hong Kong stock exchange in HK$$ (HKD) just like any other normal domestic company lists its Initial Public Offer (IPO).

ADR is a term used in the context of stock markets. It is a receipt or certificate that represents shares of a foreign stock. It is issued by a U.S. bank to a person who is interested in buying shares of a foreign stock or non-US Company through the U.S. stock exchange. ADR was introduced in 1927 to offer U.S. investors an easier way to buy stocks of foreign companies.

Some analysts argue that there should be a price differential per share between the ADR and the HKD listed share.The argument is prefaced because the ADR is entitled only to contractually receive profits made by the Alibaba Group.

This is defined as a Variable Interest entity position (VIE). A variable interest entity (VIE) refers to a legal business structure in which an investor has a controlling interest despite not having a majority of voting rights, unlike ordinary equity shareholders. Or it may refer to an accounting structure involving equity investors that do not have sufficient resources to support the ongoing operating needs of the business. In most cases, the VIE is used to protect the business from creditors or legal action.

This effectively means that the ADR holder does not own a direct interest in any of the Alibaba group companies.Whereas the HKD shareholder owns a direct interest in all of Alibaba group companies - as evidenced in India, for example,a shareholder in Tata Steel India would also have a direct interest in Tata Steel Europe which is a subsidiary of Tata Steel.

Now if there is only a VIE interest in the Alibaba ADR relative to the HKD share then logically the HKD share should trade at a premium to the underlying ADR share. So far this is not the case. Further, every ADR holder can convert the ADR into 8 underlying HKD shares by following a laid-out process of conversion. This aspect of fungibility in effect puts the ADR on par with the HKD share and it remains to be seen if the premium argument prevails.

An analysis of a specific company, in this case, Alibaba, would be incomplete without a comparison to a rival firm operating in a similar business. I chose Amazon given its brand appeal, it's a business model similar to that of Alibaba and with a strong market share in the US – the largest economy today.

Alibaba is perhaps the world's largest e-commerce company. It straddles the China market with an almost 80% market share. Its other businesses include Cloud and Digital Advertising. It operates a B2B model as also a B2C model on the web.

China's digital penetration is estimated at 60% and therefore there is an opportunity to grow penetration and market share even further.

Further Alibaba's new businesses like cloud and digital advertising are growing but are yet to turn profitable. When they do there will be an added impetus to profits.

Alibaba's revenue growth has been on an average of between 35% to 40% over the last few quarters. The recent IPO raise in Hong Kong netted it approx US$ 13 bn. Today it sits on cash of approx US$ 40 bn. It is expected to put this cash through an aggressive work out program. Recently, it announced a tie-up with Manchester United exclusively to access the clubs sports content for its China fans including exclusive seats, shows, and performances, merchandise, etc for Alibaba’s paid offerings to its clients.

At a P/E ratio of 24 times compared to approx 70 times for Amazon and with a higher growth trajectory, the stock looks inexpensive.

The major risk in this stock could arise from a China slow down, increased trade war intensity and China's authoritarian govt. Not withstanding this risk, it must be noted that Alibaba's figures still stand out impressively. Let’s take a quick look at some of these stats.

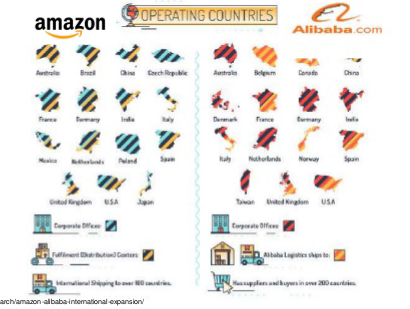

First, it handles more volumes than Amazon and eBay. Twice as more than Amazon and three times more than eBay. Second, it’s not far behind Amazon in terms of sales volumes. Third, it operates in as many countries as its competitor. And, finally, its ranked No. 6 globally in terms of its market cap.

Given these stats, why wouldn’t you want to own a piece of this enterprise?

The above case study is not an exercise to promote a specific stock. There is no doubt that cross country diversification must be included in investment portfolios, hence the case for diversification within the permissible regulations in India.

Further structures overseas is crucial in understanding valuations. We do hope that SEBI will enhance this diversification strategy through the mutual fund route. About a dozen overseas feeder funds are available in India with the approval of SEBI however, the combined AUMs of these products are less than Rs 10,000 crores. The benefits of investing in such schemes need to be brought out consistently. Evidence suggests that including a cross country diversification strategy in an investment portfolio reduces volatility, improves returns over the long terms and builds a downside risk protection strategy.

Give us a call or write to us to know more about overseas products and any other queries related to this article. SELECT INVEST RELAX the Phundo way!

Credits: Java T Point, Repricer Express, Nikhil Kapadia, The Economist

Mutual funds are subject to market risks. Please read the offer document and contact your advisor before investing