Update

Update

As the Equity market continues its merry-go-round, mis-information rules the minds of people. Not so long-agoself-proclaimed gurus of the investing world stated their outlook on stocks of large cap companies in India. Headlines (such as the one present below) clouded the judgement of investors and people thinking remotely of getting their feet wet in the equity market.

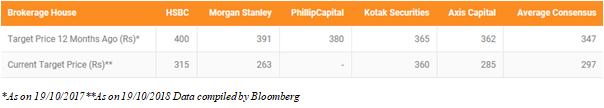

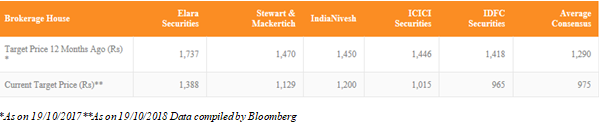

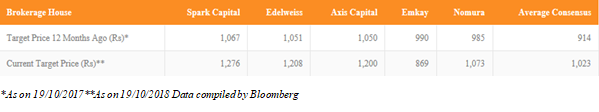

Phundo scrutinized the analyst recommendations pushed out through the digital and electronic mediums and found the following interesting facts: -

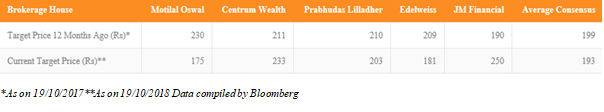

Outlook on Vedanta

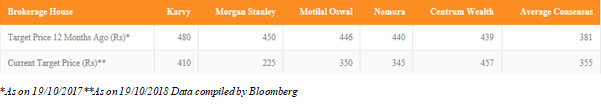

Outlook on InterGlobe Aviation (Indigo Airlines)

Outlook on SUN TV

Outlook on L&T Finance

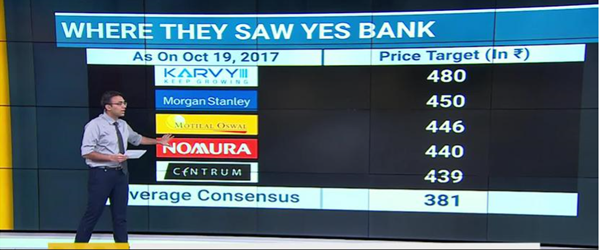

Outlook on Yes Bank

In the examples above, notice the variations of the predictions churnedout by equity analysts over a one-year timeframe – October 2017 & October 2018. To ensure that the examples sighted above are not just few taken out of context, Phundo analysed a larger universe of the large-cap market with “aggressivebuy-calls”. Here’s what we found.

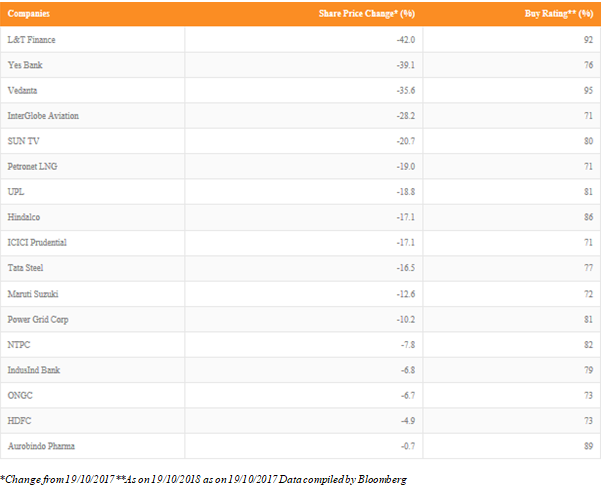

Large Caps that disappointed investors

The learning from the above exercise clearly exemplifies thepoint “follow the fundamentals”and “reject the rhetoric”. Use the mutual fund route to let the experts who follow the fundamentals closely help you create wealth in the mid-to-long-term.

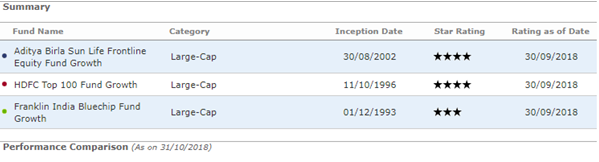

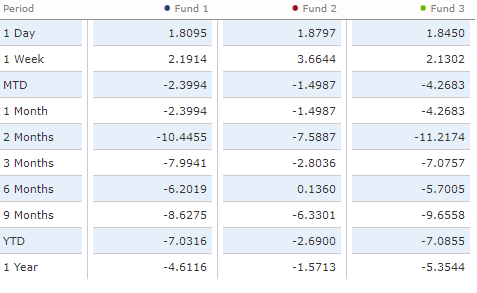

Let’s expand this statement when analysing mutual funds. Phundohas taken three large-cap equity funds rated 3 & 4 stars by Morningstar.in. These funds have companies such as those listed above with aggressive “buy-calls” from equity analysts.

On a 1-year basis, while the Nifty 50 (benchmark) has delivered 0.63% return, our three large-cap funds have delivered a negative return of 3.8%. On the other hand, if you bought direct stocks based on the analyst ratings, you would have lost at an average of 14.7%.

This shows that mutual fund managers who have resources to “follow the fundamentals” of the company have delivered higher returns in comparison to investors buying these stocks directly from the market.

Aggressive buy calls don’t change the price. BIG talk doesn’t get you the returns. Generating returns requires, diligence, detail, depth and data. At Phundo the algorithm equation is D4 = Returns.SELECT INVEST and RELAX with Phundo.com – India’s most trusted and well-established mutual fund advisory platform.

Write to us on support@phundo.com-we always look forward to and appreciate your views and feedback.

Disclaimer: Mutual Fund investments are subject to market risks. Please read offer document before investing. Past performance does not indicate future returns.