Update

Update

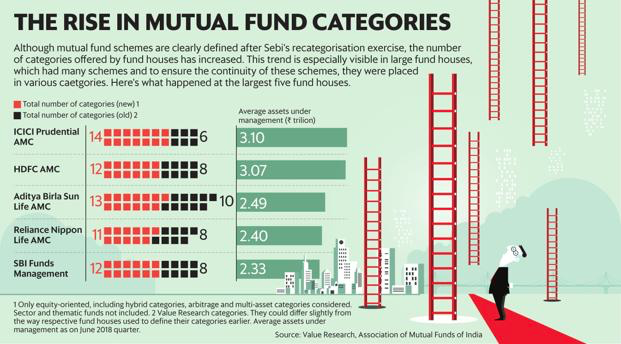

In India we have 44 Asset Management Companies and they manage 2500 + Schemes with 38 schemes categorisation. As an Investor how do you select a category or schemes that best suits you ?

Phundo’s 10 Commandments of Mutual Fund Advisory :

1. Mutual Funds are “SOLUTIONS” not “PRODUCTS”

Phundo strongly believes in offering Mutual Funds on the basis of “solutions” rather than just a fund or a product because our philosophy is that investing in Mutual Funds is to meet various life goals. The goals can be short term, medium term and/or long term.

If Mutual Funds are solutions then how does one choose the right fund that suits the objective can be a very daunting question for both advisors and investors. Phundo endeavours to align the objectives of investors with the selection of funds.

2. Focus on Categories before Schemes.

Most investors just invest in a Mutual Fund scheme, they hardly choose the “category” which is critical for the end results to be good. Further, choosing fund houses, understanding the categories, understanding schemes and then how many schemes should be part of an investor’s investment strategy can all be complicated.

3. Mutual Funds Categories

Let’s understand the selection process. There are over 44 Mutual Fund houses or asset management companies in India that are managing portfolios worth Rs.25 lakh crore across debt and equity as on October 2019. This itself is the first problem, from these many fund houses which fund houses should be chosen.

The next problem is to pick the right categories such as liquid funds, ultra short term funds, low duration funds, short term debt funds, medium term debt funds, credit risk funds, income funds, gilt funds, fixed maturity plans, index funds, conservative hybrid funds, aggressive hybrid funds, dynamic hybrid funds, large cap funds, large & mid cap funds, multi cap funds, mid cap funds, small cap funds, value funds, focused funds, thematic funds, sector funds, global market funds, fund of funds….. phew… isn’t it very confusing and seem complicated?

4. Mutual Fund Jargons

There are some important jargons too to understand such as YTM, Average Maturity, Macaulay Duration, Modified Duration, Credit Rating, Money Market Instruments, Bond Market Instruments, Interest Rate Movement and Direction, Benchmark and Side Pocketing; Mean, Standard Deviation, Beta, Sharpe Ratio, Sortino Ratio, Alpha, Expense Ratio, Exit Load, Benchmark, Indices and so on. Picking right categories and right schemes after understanding these parameters is the right way of investing.

5. Can you choose the right Debt Fund among Two ?

Let’s take a test: there are two short term debt funds managed by two different Mutual Fund houses which have similar “average maturity” of 2.50 years, but the YTMs are different. Fund A’s YTM is 9.00% while Fund B’s YTM is 8.00%, which means if an investor holds the investment for the full period of 2.50 years he/she could receive the given YTM yield. Which one will you choose between Fund A and Fund B? You would most probably choose Fund A because the yield is better and higher than Fund B, but are you doing the right selection?

Let’s see how we can differentiate between the yield of Fund A and Fund B: Fund A has 25% invested in AAA debt papers (highest safety grade) while Fund B has 75% of AAA debt papers. It can be easily understood now that the extra 1.00% has come because of lower exposure to safe papers. Are you okay to choose a fund that has lower exposure to safe debt papers ?

6. Can you choose the right Equity Fund among the two ?

Let’s take another test: there are two diversified equity funds (assumed as multi cap fund), Fund X and Fund Y; over a period of 5 years Fund X has offered compounded annual return of 15% while Fund Y has offered return of 17%. Which from the two funds would you choose to invest? Of course, you would choose Fund Y for obvious reasons.

But if you get to the depth of the portfolio and check some risk-reward parameters Fund Y has higher Standard Deviation and lower Sharpe Ratio compared to Fund X. Which means the future returns from Fund Y will be highly unpredictable while the returns from Fund X would be more predictable. So here Fund Y would be a risky bet compared to Fund X. Did you do the right fund selection then ?

7. The Misery of chasing high returns over safety

Generally common investors choose high returns over safety; the recent co-operative bank scam (PMC Bank) in Maharashtra is an example of such chasing high returns over safety. Instead of investing their hard earned money in a PSU bank common household individuals chose a co-operative bank that was offering higher return on fixed deposits compared to main stream banks.

Similar scams have been experienced in Bangalore as well with IMA Jewels that swindled common investors’ money because they were chasing high returns. Phundo does not believe in offering or recommending schemes that are high on return because we don’t compromise on quality of the portfolio for higher returns.

8. Fund House Selection

Fund selection is a process at Phundo, it is about pedigree and lineage of the fund house, fund management team, their experience and the legacy that matters while choosing fund houses. Phundo by and large chooses to bet on fund houses that has a blend of being in the business for a long time and also the methods adopted by the fund managers to manage both debt and equity portfolios. There is no need to chase high returns because over long term achieving consistent returns is what matters.

If an equity fund has generated CAGR in the range of 15% over 10, 15 and 20 years duration we like such funds. In debt funds we like schemes with larger AUM (assets under management) and higher exposure to AAA and AA papers. We also avoid long maturing debt schemes while we stick to debt funds with maximum of 3 years of average maturities. If the YTM is 1% above the bank deposit rates we are happy to offer to our investors because after indexation benefit the net returns would still be worth. Further, we avoid equity funds that are not launched before 2008–09 because we like an equity fund that has gone through at least one market crash, the last such crash happened during 2008–09. Longer the equity fund being in existence we like them a lot and make them part of our fund selection universe.

9. Portfolio based Investing

Diversification is like having different dishes on your food plate; it should neither be a buffet type spread where you are spoilt for choice or too less where it doesn’t excite you to eat. Phundo believes that to achieve a particular return on investment from equity mutual funds it is imperative to invest as a portfolio.

Let’s explain why portfolio based investing offers better results:

As can be noticed from the graph the stocks in the stock market are segregated based on companies being small, medium and large that also depicts the risk associated.

At the bottom of the curve the risk would be higher so can be the returns; at the middle the risk would be medium to high so could be the returns; at the top of the curve the risk would have reduced where the returns could also be comparatively less as compared with small and mid-sized companies. Hence, it would be imperative for investors to choose a right blend of index funds, hybrid funds, large cap funds, multi cap funds, mid cap funds and small cap funds. It could be 30% exposure to large cap funds, 30% exposure to multi cap funds and 40% exposure to mid cap funds that suits a particular type of investor based on risk-return expectations. In another case the exposure to mid cap and small cap could be as high as 80% while large cap may have only 20% exposure. Phundo offers such customized mutual fund portfolios that meets with objectives of different types of investors.

10. The role of PHUNDO as a Mutual Fund Advising Platform

It may be fine to buy a head ache tablet or a cough syrup directly from a chemist (medical shop) surpassing a doctor (doctor’s fee actually), but to buy a bouquet of medicines for an ailment or for a bigger health problem surpassing a doctor would be dangerous. Phundo is your family wealth doctor and we prescribe the right portfolio because we are prescribing a bouquet of investment opportunities that is aimed at your financial wellbeing.

PHUNDO’S MOTTO “A SUCCESSFUL INVESTOR SHOULD BE AN OUTCOME OF SUCCESSFUL ADVISORY”

Disclaimer. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including the fluctuations in the interest rates.